If you’ve already begun thinking about planning to spend your tax refund, don’t worry. You’re not the only one. Every year millions of taxpayers look in search for the IRS Tax Refund Schedule 2026 to discover the date their refunds will arrive in their bank accounts. Although the IRS does not publish an exact calendar for refunds (because, of course) there are accurate timelines dependent on the method of filing and the amount of credits claimed and IRS processing guidelines.

This guide explains the latest IRS Tax Refund Schedule 2026, what factors affect the speed of refunds and how you can monitor your refund with out the need to visit your IRS webpage every 5 mins.

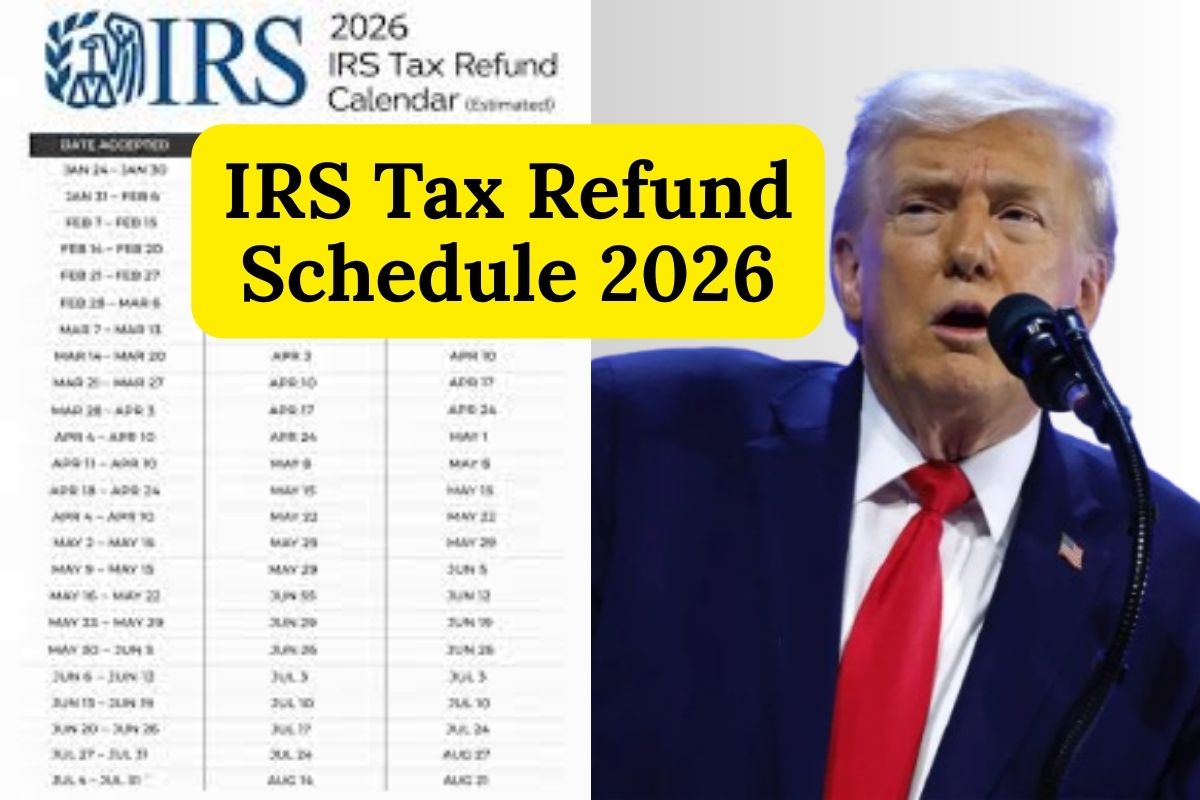

IRS Tax Refund Schedule 2026 – Quick Overview

Before we get into the details, here’s an overview of what taxpayers should be expecting.

| Filing Method & Situation | Expected Refund Timeframe |

| E-file + Direct Deposit | 8-21 days after acceptance |

| Paper Return (Mail) | 6-8 weeks (or longer) |

| Refunds made using EITC or ACTC | Late February until the beginning of March 2026 |

| Errors or Manual Review | From a few weeks to months |

| Identity Verification Required | Refunds are delayed until the refund is verified |

Read More: IRS New Tax Changes 2026

When Will the IRS Start Issuing Refunds in 2026?

The IRS generally starts receiving tax refunds around the latter part of January. Based on the past the refund processing process in 2026 is likely to follow the same timeline.

- IRS e-file opening: Late January 2026

- First refunds given: Early February 2026

- Peak refund period: February-March 2026

If you’re filing electronically and opt for Direct Deposit, then you’re doing it right.

Read More: New York $1,000 Child Tax Credit 2026

How Long Does It Take to Get a Tax Refund in 2026?

The IRS official statement is that the majority of refunds are given after the 21-day period of filing electronically. The IRS says that “most” does quite a bit of work.

Typical IRS Tax Refund Schedule 2026: Timelines

- E-file + direct deposit: 1-3 weeks

- E-file + paper check: 3-4 weeks

- Paper filing and checking: 6-8 weeks (sometimes longer)

Paper tax returns are slow, not because the IRS is impolite, but because human beings still need to go through them.

Why Some Refunds Are Delayed in 2026

If you do file earlier the process can be slowed by a variety of factors.

Common Reasons for Refund Delays

- Errors in the income and filing status or details of a bank

- The Social Security numbers are not correct or in the wrong place.

- Credits that are refundable, such as EITC and ACTC

- Identity Verification request

- IRS Backlogs in the system or manual reviews

If your request is marked for review, the 21-day rule is politely ends the chat.

Read More: IRS Free File 2026 – How to file your return at no cost

Special Rule for EITC & ACTC Refunds (Very Important)

If you claim:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

IRS cannot legally authorized to make a refund prior to the mid-February date.

Expected Timeline for EITC / ACTC Refunds

- IRS processing begins: Late January

- Refunds will be released on or after February 15, 2026

- Direct deposit processing: late February to March

This law is designed to prevent fraud, not to make you test one’s patience (though it is a good thing too).

Read More: VA Claim Status 2026 – Here’s How to Check your VA claim

IRS Tax Refund Schedule 2026: Month-by-Month Breakdown

January 2026

- IRS begins accepting returns

- Early filers send returns

- Refund clock officially starts

February 2026

- First refunds of the first wave issued

- A majority of refunds that are e-filed processed

- EITC/ACTC refunds are still held until February mid-February.

March 2026

- The majority of refunds are completed

- Returns that are delayed and reviewed continue processing

April-May 2026

- Late filers get refunds

- Paper returns are still being processed

How to Check IRS Refund Status in 2026

The most effective and fastest method is to use the “Where’s My Tax Refund?” tool provided by the Internal Revenue Service.

You’ll Need:

- Social Security Number or ITIN

- Status of the filing

- Exact amount of refund

The program updates every hour and usually happens overnight. So having it checked 20 times a day won’t do much (but we’re aware).

Direct Deposit vs Paper Check: Which Is Faster?

Let’s keep this as simple as possible.

- Direct Deposit The fastest, most secure and has the least drama

- Paper Check: Slower, mail delays, higher risk

If speed is important (and it can) Direct deposits are not negotiable.

Tips to Get Your Tax Refund Faster in 2026

Do you need your refund as soon as possible? Try this:

- File electronically (always)

- Verify names and SSNs and bank information

- Avoid filing with paper unless it is absolutely required

- Make sure you use a trusted tax software, or a tax preparer who is qualified

- Start early but make sure you have all your tax documents

Accuracy outperforms speed every time.

What If Your Refund Is Still Delayed?

If your refund is delayed than you expected:

- Check Where’s My Refund?

- Find IRS Notices from the IRS in your mailbox or on your online account

- Respond immediately if verification requests are made

- Re-filing is not recommended until the IRS gives you a specific instruction.

The IRS should be the last option and not the first step.

Frequently Asked Questions (FAQs)

1. What is the IRS tax refund schedule 2026?

The IRS is not able to provide an exact date, but the majority of refunds filed electronically are processed after two weeks and paper returns could take up to 6-8 weeks or longer.

2. When will the first IRS refunds be issued in 2026?

The refunds are scheduled to start in the beginning of Feb 2026 for those who file early using direct deposit.

3. What is the reason my tax refund delayed?

The most common reasons are claiming refund credits, errors on the tax return identification verification, or the manual IRS review.

4. When EITC as well as ACTC refunds be paid out in 2026?

As per law, refunds aren’t allowed to be made before the middle of February. The majority of taxpayers are notified within late February or March.

5. What can I do to keep track of my IRS refund for 2026?

Use the IRS Where’s My Refund? tool with your SSN, filing status and the amount due for refund to get real-time updates.

Final Thoughts

This IRS Tax Refund Schedule 2026 isn’t specific about dates; it’s about making smart choices when filing. If you file your tax return early, make direct deposit and stay clear of errors, your refund should be received in a timely manner. If not, well… patience is an important part of your tax strategy.